Traders' Tip text

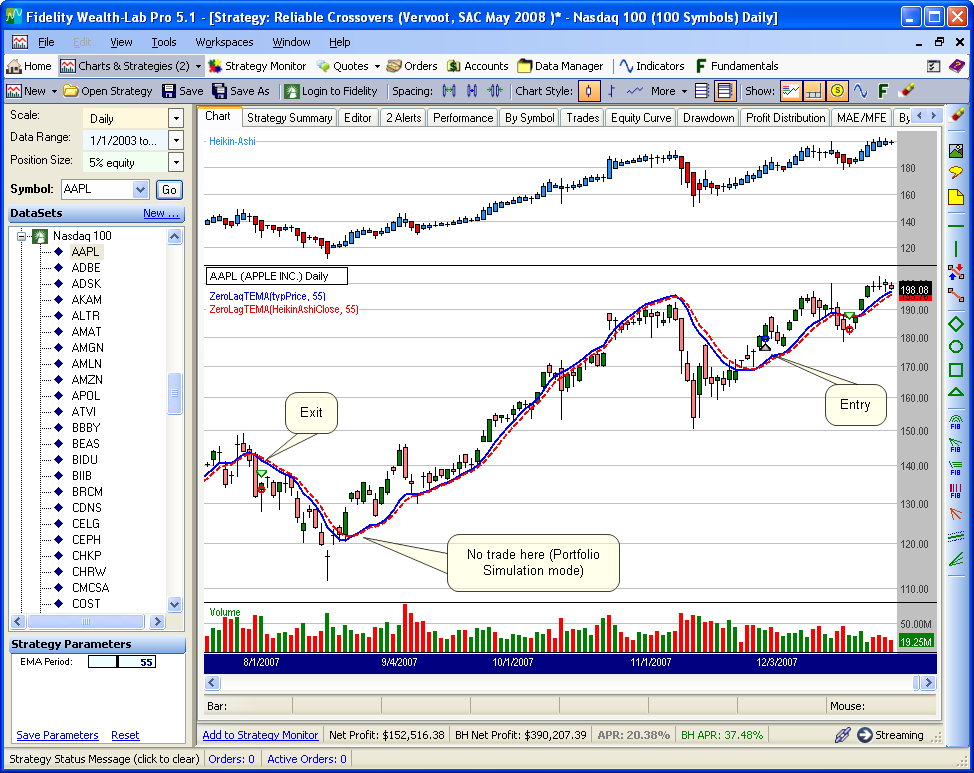

The code for Wealth-Lab Version 6 for the suggested zero-lag Triple EMA crossover system is presented. We interpreted the “power of analyzing” logic to exit for a profit when the averages cross, but exit for a loss at the lesser price of a 10% stop loss or a close lower than the lowest low of the 21 bars prior to entry. Running that strategy in Portfolio Simulation mode using 5% of equity per trade on the Nasdaq 100 over the 5 years ending 12/31/2007 resulted in gains of approximately 21% annualized. The actual result varies from simulation to simulation since the portfolio can hold only 20 positions simultaneously using the 5% of equity sizing method. The Buy & Hold strategy, however, returned nearly 38% APR over the same period.

Figure 1.

Figure 1. Note that one of the crossovers did not result in creating a simulated trade. This is not an error and due to the results of a Portfolio Simulation in which insufficient equity existed at the time of the trading alert. The WealthScript code also creates the Heikin-Ashi chart style.

Strategy Code

using System;

using System.Collections.Generic;

using System.Text;

using System.Drawing;

using WealthLab;

using WealthLab.Indicators;

using TASCIndicators;

namespace WealthLab.Strategies

{

public class ReliableCrossovers : WealthScript

{

// Create slider parameter(s)

private StrategyParameter emaPeriod;

public ReliableCrossovers()

{

emaPeriod = CreateParameter("EMA Period", 55, 10, 120, 5);

}

public DataSeries ZLTEMASeries(DataSeries Source, int Period, EMACalculation calcType)

{

DataSeries tma1 = TEMA.Series(Source, Period, calcType);

DataSeries tma2 = TEMA.Series(tma1, Period, calcType);

return tma1 + (tma1 - tma2);

}

protected override void Execute()

{

/* Create a Heikin-Ashi chart above the main PricePane */

DataSeries HO = Open + 0; // intializations

DataSeries HH = High + 0;

DataSeries HL = Low + 0;

DataSeries HC = (Open + High + Low + Close) / 4;

DataSeries haC = HC + 0;

haC.Description = "Heikin-Ashi Close";

for (int bar = 1; bar < Bars.Count; bar++)

{

double o1 = HObar - 1;

double c1 = HCbar - 1;

HObar = ( o1 + c1 ) / 2;

HHbar = Math.Max( HObar, Highbar );

HLbar = Math.Min( HObar, Lowbar );

haCbar = ( HCbar + HObar + HHbar + HLbar ) / 4;

}

ChartPane haPane = CreatePane(40, true, true);

PlotSyntheticSymbol(haPane, "Heikin-Ashi", HO, HH, HL, HC, Volume, Color.DodgerBlue, Color.Red);

//Obtain SMA period from parameter

int period = emaPeriod.ValueInt;

double stop = 0d;

double LL = 0d;

DataSeries typPrice = ( High + Low + Close ) / 3;

DataSeries zlTyp = ZLTEMASeries(typPrice, period, EMACalculation.Modern);

zlTyp.Description = "ZeroLagTEMA(typPrice, " + period + ")";

PlotSeries(PricePane, zlTyp, Color.Blue, LineStyle.Solid, 2);

DataSeries zlHa = ZLTEMASeries(haC, period, EMACalculation.Modern);

zlHa.Description = "ZeroLagTEMA(HeikinAshiClose, " + period + ")";

PlotSeries(PricePane, zlHa, Color.Red, WealthLab.LineStyle.Dashed, 2);

for(int bar = period; bar < Bars.Count; bar++)

{

if (IsLastPositionActive)

{

Position p = LastPosition;

stop = Math.Min(LL, p.EntryPrice * 0.9);

if( CrossUnder(bar, zlTyp, zlHa) && Closebar > p.EntryPrice )

SellAtMarket(bar + 1, p, "Profit");

else if( Closebar < stop )

SellAtMarket(bar + 1, p, "Stop Loss");

}

else if( CrossOver(bar, zlTyp, zlHa) )

{

LL = Lowest.Series(Low, 21)bar;

BuyAtMarket(bar + 1);

}

}

}

}

}