Page History: AlphaVantage static data provider

Compare Page Revisions

Page Revision: 2020/08/16 13:12

What it is

This is a Wealth-Lab static and fundamental provider for

free intraday and daily data for U.S. stocks, Forex and cryptocurrencies by

AlphaVantage. The EOD data spans 20 years while the intraday data is limited depending on bar scale (1-minute: 1 week, 5-minute: 4 weeks, 15-, 30-minute: 6 weeks, 60-minute: less than 3 months for stocks and less than a month for Forex).

If you're familiar with the built-in Yahoo! provider, you're going to get common with the Alphavantage provider very quickly. Its features include:

- the split and dividend history for U.S. stocks is stored locally and can be optionally applied to price data. This means that DataSet refreshes are never required in order to apply the most-recent split and dividend data.

- Chart Annotations: "Split (AlphaVantage)" and "Dividend (AlphaVantage)".

- On-demand data requests supported.

- Support for GetSessionOpen, Strategy Monitor and Market Manager.

Setting it up

Before you're able to download any data, follow these steps:

- Install the extension and restart WLP/D

- Get your free API key at AlphaVantage.co or subscribe and get a premium key at AlphaVangtage Premium

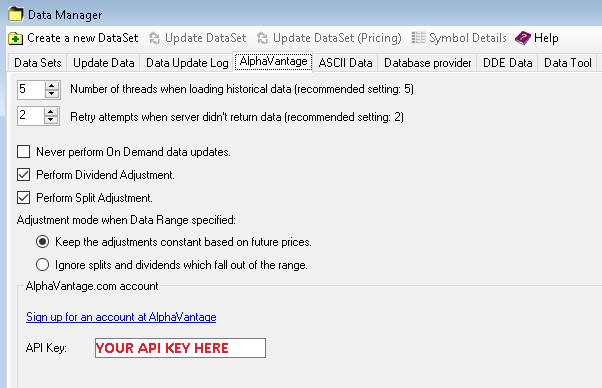

- Copy and paste your API key (no typing !) on the Data Manager's AlphaVantage tab

Provider tab in Data Manager |

- Never perform On Demand data updates: Overrides Wealth-Lab's On demand update option so that backtests in the Strategy Window/Monitor always run quickly with cached data.

- Perform Dividend/Split Adjustment: Data are adjusted at the moment they're passed to Wealth-Lab by the Tiingo provider so that the newest dividends are applied automatically to the price data. Note that split and dividend adjustments affect both price and volume. The dividend adjustment factor equation is 1 - dividend/close. Prices (pre-ex-date) are multiplied by the adjustment factor(s), whereas the factor becomes the divisor for volume.

- Adjustment mode when Data Range specified: Choose "Keep" so that price and volume data are always the same, historically, even when specifying a past data range. "Ignore" is an advanced option for testing with past adjusted data without the influence of future splits or dividends that are excluded from the chart's Date Range.

- To use the right-click bar data editor for anything besides deleting a bar in a Tiingo chart, you must apply the "Keep" option during the edit. See Data Editing below.

Forex

Forex symbols must have

FFF/TTT format, where

FFF stands for From-Symbol and

TTT stands for To-Symbol, for example: EUR/USD, USD/CHF etc.

Cryptocurrencies

We tested cryptos with

FFF-TTT format, where

FFF stands for From-Symbol and

TTT stands for To-Symbol, for example: BTC-USD.

Working with Dividends

The fundamental provider may return split-adjusted dividends for a chart's dividend popup as well as when accessing the "Dividend (Alphavantage)" fundamental item in Strategy code. While the dividend adjustment factor maintains proper percentage relationships between prices, it's possible that new dividends affect previous backtest results (trades) for some strategies. Disable "Apply dividends" in the Backtest Settings Preferences when using dividend-adjusted data for backtesting. If you don't, the dividend effect might be duplicated in the Performance results, especially for the Buy & Hold Strategy.

Data Editing

To edit bar data, open a chart and either:

- double-click the bar to edit, or,

- right-click the bar and select Edit Bar Data.

When editing data, be aware of the Perform Dividend Adjustment selection since the chart values will reflect this adjustment. Deselect this option and refresh the chart to edit raw price and volume.

With the "Ignore splits and dividends which fall out of the range" option selected (disabled by default), only deleting bars is possible.

Issues and Limitations

- Under investigation: When Market Manager support is enabled, the bars on some timeframes may be incorrectly filtered out. Workaround: disable AlphaVantage provider in the MM.

- Forex data itself has issues currently: flatline weekend bars in the intraday data, weekend bars and crippled bars in the EOD data.

- Price data itself lacks company name

- Intraday data can have gaps due to splits and dividends that the provider doesn't account for since the split/dividend data is missing (doesn't apply to EOD)

- Cryptocurrency data is not supported, and its support is not planned. Use Cryptocurrency (Bitcoin) data provider instead.

- Check out the feed's website for usage quota/limitations on the free tier (e.g. 5 requests per minute) or premium plans.