This is a must-have tool for properly executing a system with pyramiding (scale-in) rules on a portfolio of instruments in portfolio simulation mode. Without this PosSizer, Wealth-Lab's real-world simulation rules can skip the initial entry signal due to insufficient funds, but your system will be entering pyramided trades like nothing happened. This PosSizer will skip all additional entry signals if the initial trade has not been taken.

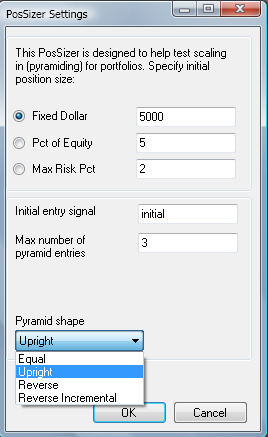

Figure 1a. Dialog |

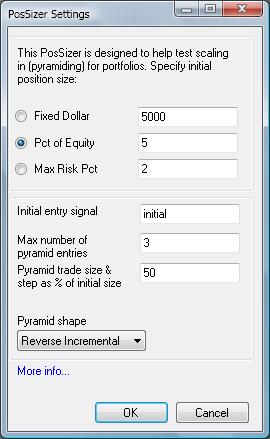

|  Figure 1b. Reverse Incremental option active. |

|

This feature requires that your entry signal name (i.e., the Position.SignalName property) is not empty. Type in the initial entry signal into the corresponding field, case is ignored. As long as the entry signal

contains the text you type here, it will be considered as the pyramid base (i.e., your initial entry signal can have additional text).

Note: AutoComplete feature is supported, suggesting you the most likely entry signal name from the list of signals generated by the system you're applying the PosSizer to.

As with most other PosSizers, the basic position size can be determined using either fixed dollar, percent of equity, or maximum risk percentage approach. You have the option to set the size of a pyramid (additional) trade as a percentage of the base size, and to define the maximum number of allowed pyramid entries (that overrides your system rules).

The shape of the pyramid

The following four pyramiding scenarios are possible with the PosSizer:

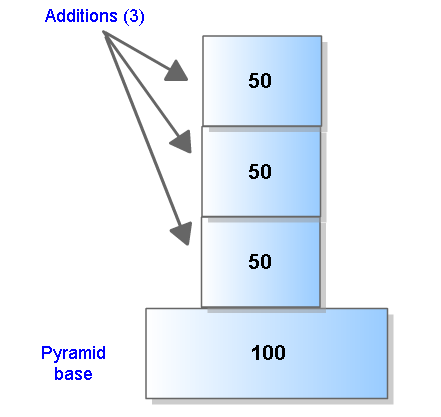

- (Figure 2) Adding equal positions. Each new entry is simply allocated the same percentage (expressed as a percentage of the pyramid "base" i.e. the first trade before scaling in starts).

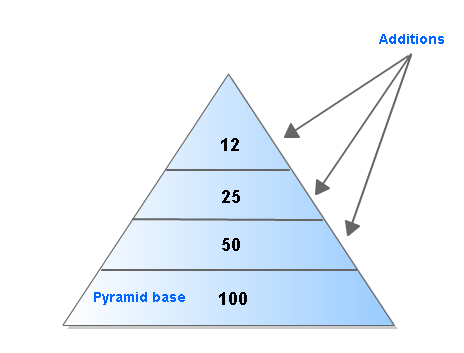

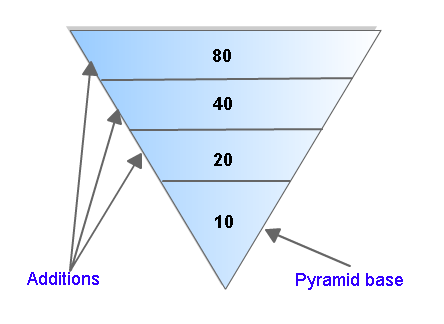

- (Figure 3) Upright (scaled-down) pyramid. When the "upright pyramid" checkbox is enabled, the pyramid shape changes considerably: each new entry is one half of the previous size (rounded down).

- (Figure 4) Reverse pyramid is the upside down version of an upright pyramid where the risk doubles with each new added trade

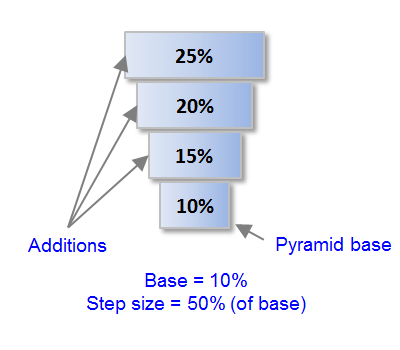

- (Figure 5) Reverse Incremental pyramid is an advanced version of adding equal positions. The risk grows progressively by the specified percentage. It's in between adding equal positions and the (much riskier) reverse pyramid.

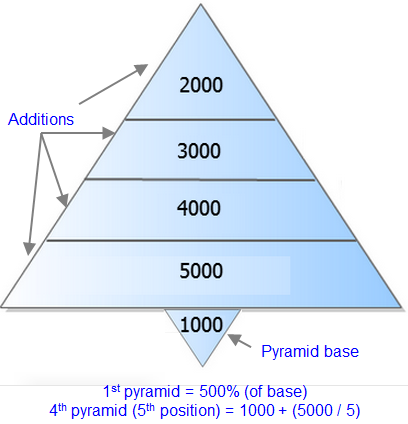

- (Figure 6) Modified Upright pyramid is a sizing scheme suggested in Trading Chaos by Bill Williams. The idea is to use a small, low-risk position when attempting a counter trend trade. If correct and the trade goes in your favor, the method quickly ramps up risk up to a present maximum. Our algorithm is a linear scale down such that the last position (assuming more than 2) will be pctOfInitial/maxEntries *greater than* the initial position. Example: Figure 6, the 5th position (4th pyramid) = 1000 + (5000/5) = 2000. If only 2 pyramids positions were specified, the 3rd position (2nd pyramid) would be 1000 + (5000/3) = 2667.

Figure 2. Upright (scaled down) pyramid |

|  Figure 3. Equal positions, pyramid trade = 50% of base size |

|

Figure 4. Reverse pyramid |

|  Figure 5. Reverse Incremental pyramid, base = 10%, pyramid step size = 50% of base |

|

Figure 6. Modified Upright, Small Initial |

|