Traders' Tip text

The Wealth-Lab Strategy code for the short-term pattern scanner by Perry J. Kaufman is presented below. With 'parameter sliders' at the bottom left of your Wealth-Lab workspace, included Strategy demonstrates how to switch between the patterns interactively when viewing a chart. Dragging the 'Pattern' slider to the left or to the right will change between the six choices and make the chart update with backtested trades.

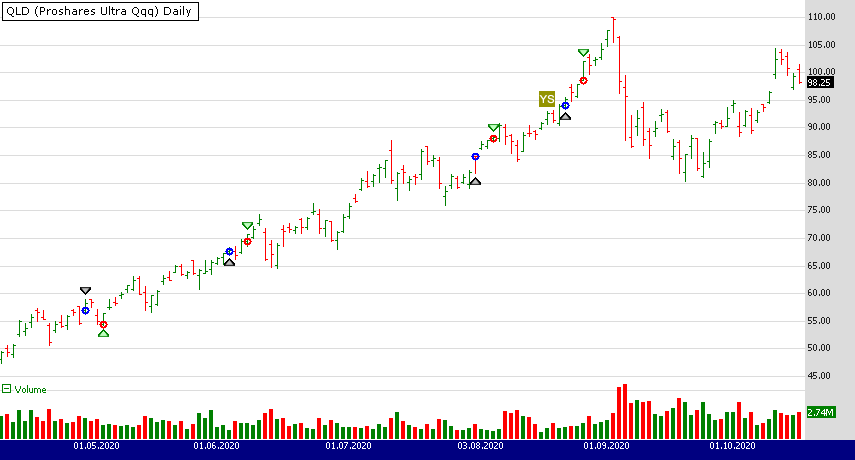

Figure 1. Sample entries on a Daily chart of QLD. Data provided by Yahoo! Finance.

Figure 1. Sample entries on a Daily chart of QLD. Data provided by Yahoo! Finance.For example, Figure 1 illustrates a bearish and two bullish key reversal trades created on the next open following the pattern and exiting 3 days after. Through another parameter slider you can control exits after N bars in a trade.

To avoid copy/paste, hitting Ctrl-O and choosing “Download…” in Wealth-Lab gets you the downloadable Strategy under the “Chart patterns” folder.

WealthScript Code (C#)

using System;

using System.Collections.Generic;

using System.Text;

using System.Drawing;

using WealthLab;

using WealthLab.Indicators;

using Community.Components;

namespace WealthLab.Strategies

{

public class TASCJan2021 : WealthScript

{

private StrategyParameter paramPattern;

private StrategyParameter paramExitDays;

public TASCJan2021()

{

paramPattern = CreateParameter("Pattern", 1, 1, 6, 1);

paramExitDays = CreateParameter("Exit after", 3, 1, 10, 1);

}

protected override void Execute()

{

var _pattern = paramPattern.ValueInt;

var _exitAfter = paramExitDays.ValueInt;

int atrPeriod = 20, maPeriod = 80;

double tick = Bars.SymbolInfo.Tick;

var atr = ATR.Series(Bars, atrPeriod);

var trendFilter = SMA.Series(Close, maPeriod);

for(int bar = GetTradingLoopStartBar(Math.Max(atrPeriod,maPeriod)); bar < Bars.Count; bar++)

{

//key reversal

bool keyRevBear = High[bar] > High[bar - 1] && Low[bar] < Low[bar - 1] && Close[bar] < Low[bar - 1];

bool keyRevBull = High[bar] > High[bar - 1] && Low[bar] < Low[bar - 1] && Close[bar] > High[bar - 1];

//island reversal

bool islRevBear = Low[bar] > High[bar - 1] && Close[bar] < Open[bar];

bool islRevBull = High[bar] < Low[bar - 1] && Close[bar] > Open[bar];

//outside day

bool outsideBull = this.isOutsideBar(bar) && Close[bar] > Low[bar] + ( 0.75 * (High[bar] - Low[bar]));

bool outsideBear = this.isOutsideBar(bar) && Close[bar] < Low[bar] + ( 0.25 * (High[bar] - Low[bar]));

//wide range day

var ratio = TrueRange.Series(Bars)[bar] / atr[bar];

bool isWRBBull = outsideBull && (ratio > 1.5);

bool isWRBBear = outsideBear && (ratio > 1.5);

//3-day compression

bool compression = CumDown.Series(TrueRange.Series(Bars), 1)[bar] >= 3;

//gap open

bool isGapUp = (this.isGap(bar) == CommonSignalsEx.GapType.FullUp) && (Open[bar] > Close[bar] + 0.5 * atr[bar]);

bool isGapDown = (this.isGap(bar) == CommonSignalsEx.GapType.FullDown) && (Open[bar] < Close[bar] + 0.5 * atr[bar]);

//trend filter

bool isBullish = Close[bar] > trendFilter[bar];

bool isBearish = Close[bar] < trendFilter[bar];

if (IsLastPositionActive)

{

/* Exit after N days */

Position p = LastPosition;

if (bar + 1 - p.EntryBar >= _exitAfter)

ExitAtMarket(bar + 1, p, string.Format("After {0}", _exitAfter));

}

else

{

switch (_pattern)

{

case 1:

if( keyRevBear && isBearish) ShortAtMarket(bar + 1, "KeyRevBear");

if( keyRevBull && isBullish) BuyAtMarket(bar + 1, "KeyRevBull");

break;

case 2:

if (islRevBear && isBearish) ShortAtMarket(bar + 1, "IslRevBear");

if (islRevBull && isBullish) BuyAtMarket(bar + 1, "IslRevBull");

break;

case 3:

if (outsideBear && isBearish) ShortAtMarket(bar + 1, "OutsideBear");

if (outsideBull && isBullish) BuyAtMarket(bar + 1, "OutsideBull");

break;

case 4:

if (isWRBBear && isBearish) ShortAtMarket(bar + 1, "WRBBear");

if (isWRBBull && isBullish) BuyAtMarket(bar + 1, "WRBBull");

break;

case 5:

if (compression)

{

if(BuyAtStop(bar+1, Highest.Series(High,3)[bar], "CompressionBull") ==null)

ShortAtStop(bar + 1, Lowest.Series(Low, 3)[bar], "CompressionBear");

}

break;

case 6:

if (isGapUp && isBullish) BuyAtClose(bar, "GapUp");

if (isGapDown && isBearish) ShortAtClose(bar, "GapDown");

break;

default: break;

}

}

}

}

}

}

Gene Geren (Eugene)

Wealth-Lab team