E-Ratio takes the MFE/MAE analysis a step further. In addition to the static value found on the

Performance+ tab, this visualizer plots the value dynamically i.e. on a bar by bar basis.

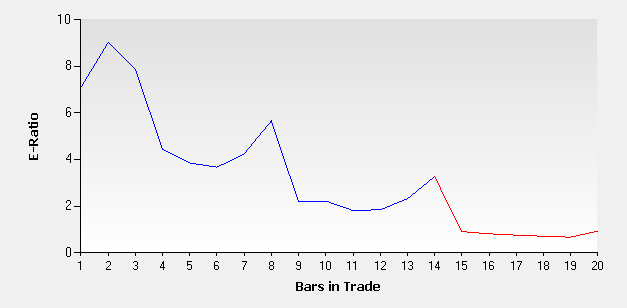

E-Ratio measures how much a trade goes in your favor vs. how much a trade goes against you. The number of bars since entry is on the X axis, the average E-Ratio is on axis Y. The higher the number the better your trading edge is supposed to be (if it's a positive value). E-Ratio is normalized for volatility to be applicable across different markets.

E-Ratio chart |

Calculation

T = total trade count

ATR = 14-bar ATR value

For a Position on a given bar, E-Ratio = (current MFE as of bar / ATR) / (current MAE as of bar / ATR)

1. On each bar X (where X varies from 0 to the longest trade duration):

a) Sum up the rolling E-Ratio of trades held for X bars or longer

b) Increment the number of trades held for X+ bars

2. Rolling E-Ratio = 1a (the sum of e-ratios) / 1b (how many trades were held for at least X bars)

Additional sources