Adaptive Laguerre: Indicator Documentation

Syntax

DataSeries AdaptiveLaguerre( DataSeries ds, int period );

Parameter Description

| bars |

Bars object |

| ds |

Data Series |

| period |

Lookback period |

Description

The Adaptive Laguerre filter is a variation on the Laguerre filter using a variable gamma factor, based on how well the filter is tracking a past

Lookback bars prices. Like other adaptive moving averages, it will track trending moves closely but will change less in range-bound markets.

References:

- The Laguerre RSI indicator created by John F. Ehlers is described in his book "Cybernetic Analysis for Stocks and Futures". It's a pretty responsive RSI successor constructed using only 4 bars of data, but compared to the regular RSI it has way less noise (whipsaws) considering its fast reaction speed.

- MESA Software: "Time Warp – Without Space Travel" (by John F. Ehlers; Word document inside an EXE archive) illustrates the LaguerreRSI construction.

Note:

Do not try to apply

AdaptiveLaguerre to itself with the same period; it will cause chart to be stuck in an endless loop. If you need to smooth the

AdaptiveLaguerre with itself, use a different period.

Example

This example illustrates how to create the Adaptive Laguerre series and plot them:

using System;

using System.Collections.Generic;

using System.Text;

using System.Drawing;

using WealthLab;

using WealthLab.Indicators;

using Community.Indicators; // Adaptive Laguerre here

namespace WealthLab.Strategies

{

public class AdaptiveLaguerreDemo : WealthScript

{

protected override void Execute()

{

// Create a 30-period adaptive Laguerre series on closing price

AdaptiveLaguerre al = AdaptiveLaguerre.Series( Bars,Close,30 );

PlotSeries( PricePane, al, Color.Blue, WealthLab.LineStyle.Solid, 2 );

}

}

}

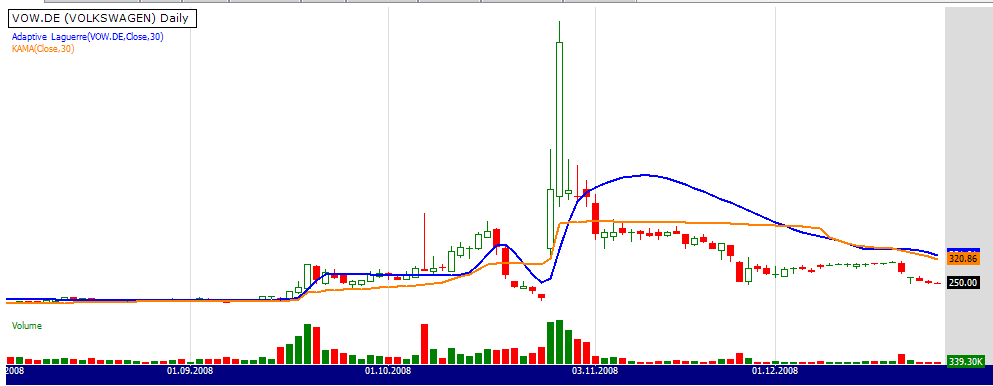

And here is how another good adaptive moving average, KAMA, compares to Adaptive Laguerre in a short squeeze environment (Volkswagen, daily):

Adaptive Laguerre vs. KAMA |