Traders' Tip text

Wealth-Lab users have long been able to backtest and trade strategies based on Renko charts. The classic version of Renko charts is included with the program as

“Renko Basic [Rev.A]” Strategy. It's a simple trend-following strategy which enters after a bullish "brick" emerges and exits after the bearish brick (vice versa for short trades).

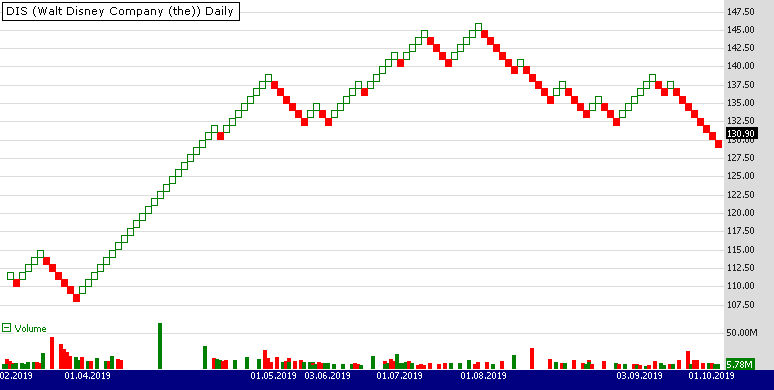

Figure 1. Basic Renko applied to a chart of DIS (Walt Disney Co.) Data provided by Yahoo Finance.

Figure 1. Basic Renko applied to a chart of DIS (Walt Disney Co.) Data provided by Yahoo Finance.

The adaptive approach that author John Devcic talks about in his article is represented with a downloadable Strategy called

“Adaptive Renko”. Its entries and exits are made in the same trend-following manner as “Renko Basic” does - except that the brick size is set to a multiple of an ATR. To get the Strategy's C# code, download it right from Wealth-Lab's "Open Strategy" dialog.

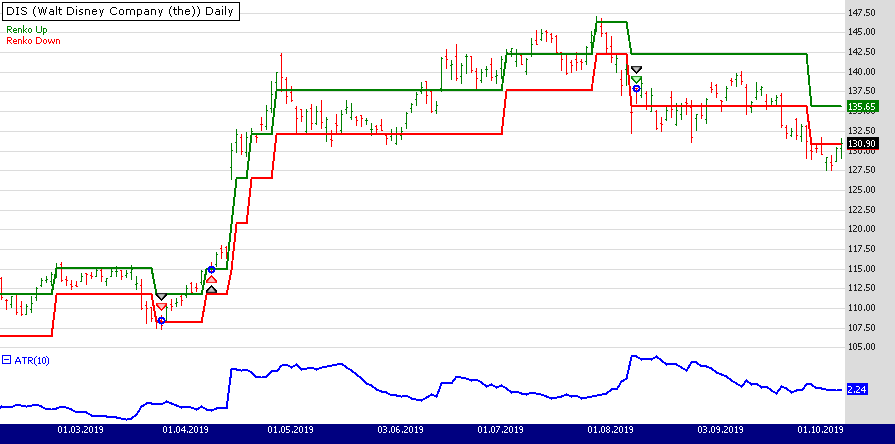

Figure 2. The adaptive “brick” size expands and contracts with volatility as the 10-day ATR changes . Data provided by Yahoo Finance.

Figure 2. The adaptive “brick” size expands and contracts with volatility as the 10-day ATR changes . Data provided by Yahoo Finance.

WealthScript Code (C#)

NoneGene Geren (Eugene)

Wealth-Lab team