Traders' Tip text

We strived to find clear rules that build a trading system in this month’s article but it doesn’t appear to contain a complete strategy. Here’s our attempt at creating something:

Entry rules- Buy next bar at open when the Leavitt Convolution Slope and the LcAcceleration both get above zero

Exit rules- Exit at market when the Leavitt Convolution Slope "reaches its peak" (as defined by rising to its 20-bar high) and then the LcAcceleration changes its sign (i.e. goes below zero).

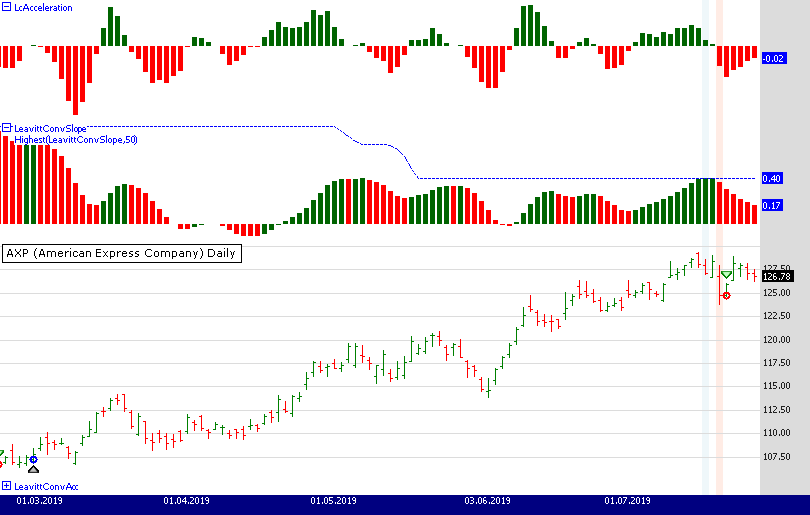

Figure 1. Trading rules applied to a chart of AXP (American Express) Data provided by Yahoo Finance.

Figure 1. Trading rules applied to a chart of AXP (American Express) Data provided by Yahoo Finance.

Figure 1 illustrates the system’s mechanics on a sample trade in AXP. In July’19 the

LeavittConvSlope indicator hits a 50-bar highest high, touching the blue dashed line. Shortly after the

LcAcceleration indicator turns down and the system is out.

To get the Strategy's C# code, no need in copy/paste: simply download it right from Wealth-Lab's "Open Strategy" dialog.

WealthScript Code (C#)

using System;

using System.Collections.Generic;

using System.Text;

using System.Drawing;

using WealthLab;

using WealthLab.Indicators;

namespace WealthLab.Strategies

{

public class Leavitt : WealthScript

{

private StrategyParameter paramLength;

private StrategyParameter paramPeak;

public Leavitt()

{

paramLength = CreateParameter("LcP Length", 50, 10, 50, 10);

paramPeak = CreateParameter("LcSlope Peak", 50, 5, 50, 5);

}

protected override void Execute()

{

bool reachedPeak = false, changedSign = false;

int peakBar = -1, signBar = -1;

int peakBars = paramPeak.ValueInt;

int Length = paramLength.ValueInt;

var LeavittProjection = LinearReg.Series(Close, Length);

int LenConv = Convert.ToInt32(Math.Sqrt(Length)); // this is how EasyLanguage extracts the integer portion of a variable

var LeavittConv = LinearReg.Series(LeavittProjection, LenConv); //inline function call

// The slope follows the same pattern. However, step 2, which defines the line, is replaced by capturing the slope of that line.

var LeavittConvSlope = LinearRegSlope.Series(LeavittProjection, LenConv);

LeavittConvSlope.Description = "LeavittConvSlope";

// The acceleration is simply the difference between two consecutive values of the slope.

var LcAcceleration = LeavittConvSlope - (LeavittConvSlope>>1);

LcAcceleration.Description = "LcAcceleration";

var LeavittConvAcc = new DataSeries(Bars,"LeavittConvAcc");

LeavittConvAcc.Description = "LeavittConvAcc";

HideVolume();

ChartPane p3 = CreatePane(10,false,false);

ChartPane p2 = CreatePane(30,true,false);

ChartPane p1 = CreatePane(30,true,false);

PlotSeries(p1, LcAcceleration, Color.Blue, LineStyle.Histogram, 5 );

PlotSeries(p2, LeavittConvSlope, Color.Blue, LineStyle.Histogram, 5 );

PlotSeries(p3, LeavittConvAcc, Color.Blue, LineStyle.Histogram, 5 );

PlotSeries( p2, Highest.Series( LeavittConvSlope, peakBars ), Color.Blue, LineStyle.Dashed, 1 );

for(int bar = 1; bar < Bars.Count; bar++)

{

SetSeriesBarColor( bar, LcAcceleration,

LcAccelerationbar > 0 ? Color.DarkGreen: Color.Red );

SetSeriesBarColor( bar, LeavittConvSlope,

LeavittConvSlopebar > LeavittConvSlopebar-1 ? Color.DarkGreen: Color.Red );

if( bar > 2 )

{

if (Closebar - 2 - 2*Closebar - 1 + Closebar > 0)

LeavittConvAccbar = 1;

else

LeavittConvAccbar = -1;

}

}

for(int bar = GetTradingLoopStartBar(1); bar < Bars.Count; bar++)

{

if (IsLastPositionActive)

{

//This exit was taken on the 30-minute chart precisely when

//LcSlope reached its peak and LcAcceleration changed sign.

var hb = HighestBar.Series( LeavittConvSlope, peakBars )bar;

if( !reachedPeak ) {

if( bar == hb ) {

SetBackgroundColor( bar, Color.FromArgb(50,Color.LightBlue));

reachedPeak = true;

peakBar = bar;

}

}

if( reachedPeak ) {

if( !changedSign ) {

if( LcAccelerationbar < 0 ) {

SetBackgroundColor( bar, Color.FromArgb(50,Color.LightSalmon));

changedSign = true;

signBar = bar;

}

if( changedSign ) {

if( SellAtMarket(bar+1, LastPosition ) ) {

reachedPeak = false;

changedSign = false;

}

}

}

}

}

else

{

if( LeavittConvSlopebar > 0 && LcAccelerationbar > 0 )

BuyAtMarket(bar+1);

}

}

}

}

}

Gene Geren (Eugene)

Wealth-Lab team