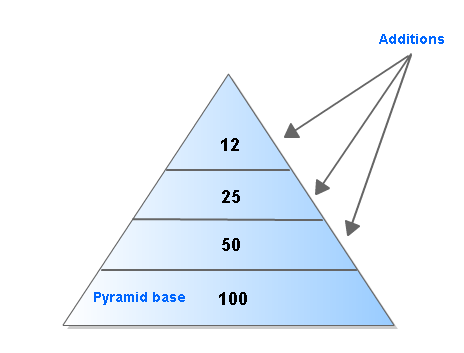

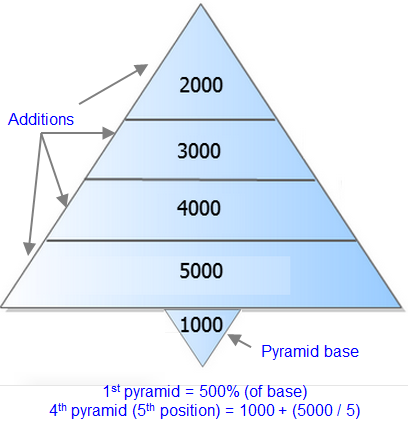

Figure 2. Upright (scaled down) pyramid |

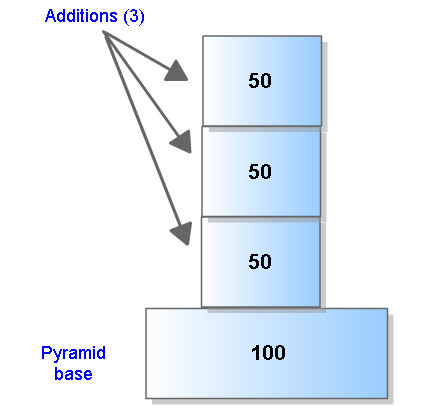

|  Figure 3. Equal positions, pyramid trade = 50% of base size |

|

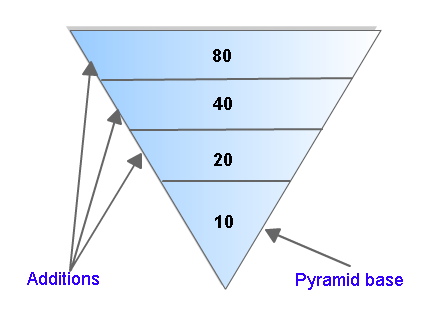

Figure 4. Reverse pyramid |

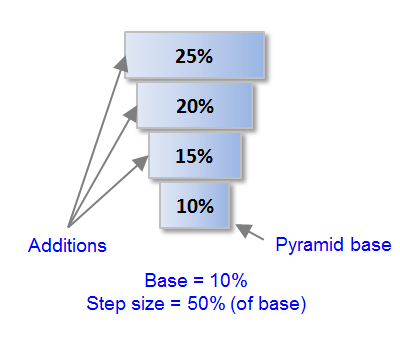

|  Figure 5. Reverse Incremental pyramid, base = 10%, pyramid step size = 50% of base |

|

Figure 6. Modified Upright, Small Initial |

|