Traders' Tip text

The

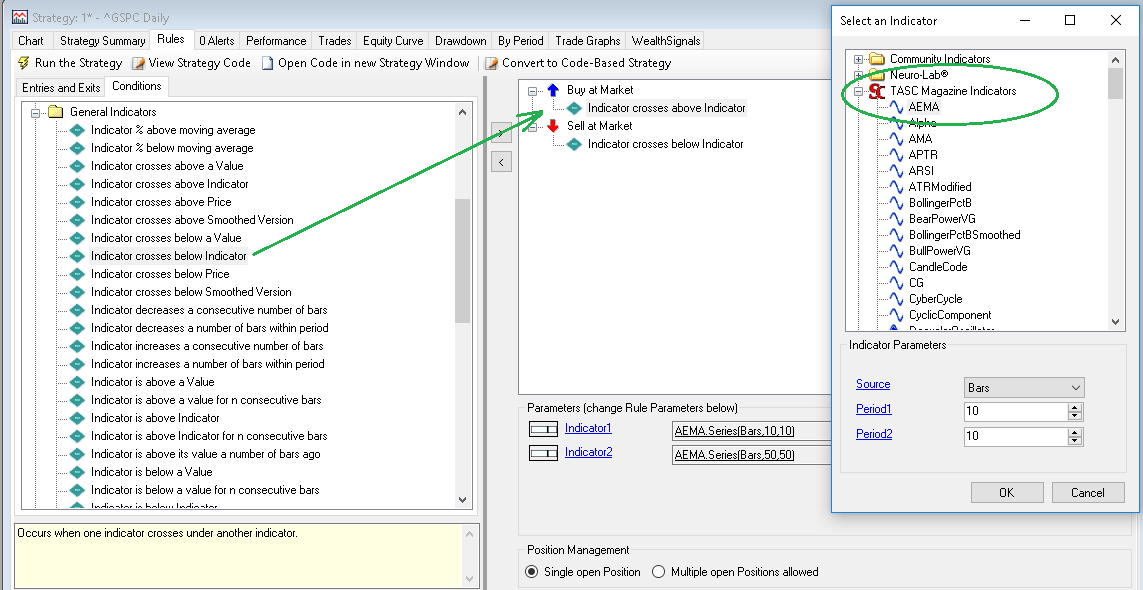

AEMA by Vitali Apirine is a new adaptive moving average. With the look and feel of EMA, AEMAs with different lengths can be used to create a trading system based on double crossovers. In a few easy steps, we'll show to set up an AEMA-based trading system in Wealth-Lab without coding.

Step 1. Install (or update) the

TASCIndicators library to its most-recent version from

our website or using the built-in

Extension Manager. Once you see

AEMA listed under the TASC Magazine Indicators group it's ready for use.

Step 2. Now add some Entry and Exit blocks, then drag and drop "Indicator crosses above (below) Indicator" from "General Indicators" under the Conditions tab on top of each one (respectively).

Step 3. For each entry and exit, choose a faster

AEMA (10,10) for "Indicator1" and a slower (50,50) for "Indicator2" where prompted.

Figure 1. Creating a Strategy based on AEMA from Rules in Wealth-Lab.

Figure 1. Creating a Strategy based on AEMA from Rules in Wealth-Lab.

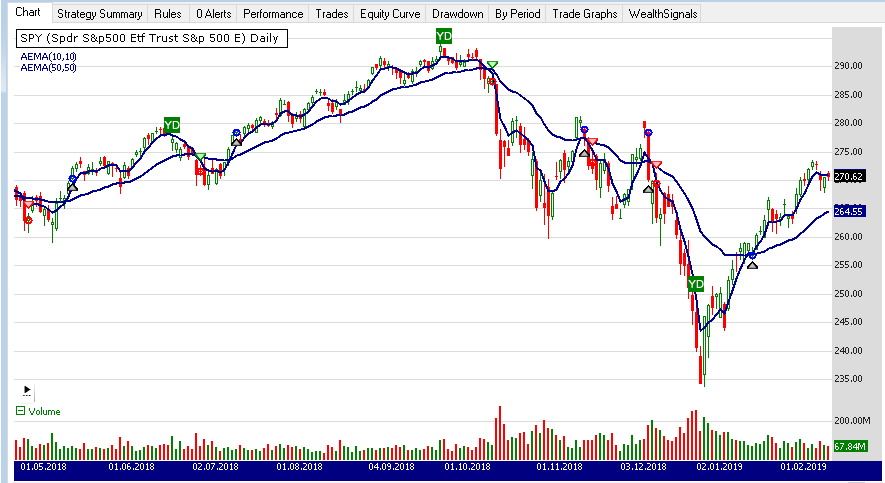

If everything's done right your trading system will generate trades like on Figure 2:

Figure 2. The example trading system applied to a Daily chart of QQQ (data provided by Yahoo).

Figure 2. The example trading system applied to a Daily chart of QQQ (data provided by Yahoo).

But the rules doesn't have to be symmetric. Here's a twist if you like to let profits ride: choose a pair of slower

AEMA periods for the exits - say AEMA(20,20) and AEMA(100,100).

Bottom line: in a couple of minutes you've prototyped a trading system without writing any code.

WealthScript Code (C#)

None

Gene Geren (Eugene)

Wealth-Lab team