Traders' Tip text

In this month's Tip space we show how to screen for symbols that meet a specified criteria as of the most recent date. The criteria here is the value of an oscillator like RS4 or RS5: the strongest ranked funds get the preference.

To set things up, first have your index funds (or whatever instruments required) in a Wealth-Lab DataSet and update their data. Then in the screener code, type in your symbol names instead of author's choice of funds:

{"FXAIX", "FNCMX", "FSMDX", "FSSNX", "FSPGX", "FLCOX", "FPADX", "FSRNX", "FSAGX", "FSUTX", "FTBFX"};

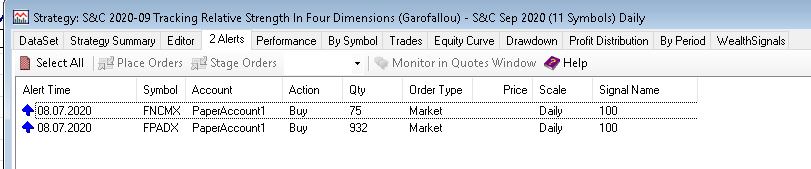

By running the screener below on a DataSet of chosen symbols in portfolio backtest mode, you'll get a list of signals to buy on the open in the Alerts view as on Figure 1:

Figure 1. A view of the Alerts tab with 2 signals with the highest reading of the RS5 oscillator.

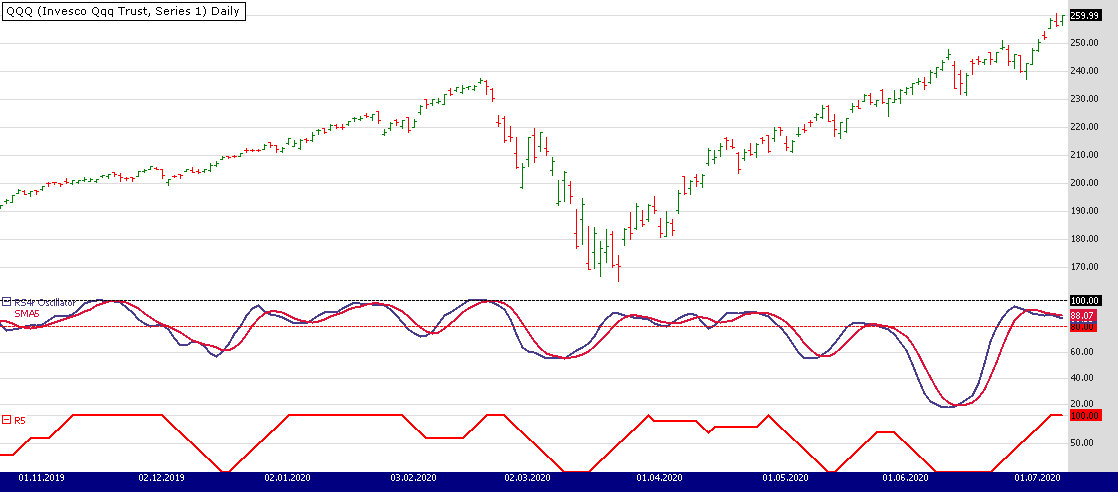

Figure 1. A view of the Alerts tab with 2 signals with the highest reading of the RS5 oscillator.If you wish to visualize the oscillators, double click on any trading signal. Wealth-Lab will plot them on a chart like Figure 2 illustrates:

Figure 2. A sample plot of the RS4 and RS5 oscillators built using author’s default set of 11 index funds on the daily chart of QQQ. Index fund data provided by Tiingo.

Figure 2. A sample plot of the RS4 and RS5 oscillators built using author’s default set of 11 index funds on the daily chart of QQQ. Index fund data provided by Tiingo.On a closing note, simply download public strategies from Wealth-Lab (hit Ctrl-O and choose "Download...") to get the trading system code below:

WealthScript Code (C#)

using System;

using System.Collections.Generic;

using System.Text;

using System.Drawing;

using WealthLab;

using WealthLab.Indicators;

namespace WealthLab.Strategies

{

public class TASC2020_09 : WealthScript

{

LineStyle ls = LineStyle.Solid;

public DataSeries RS2t(DataSeries ds, string index, int period = 10, bool plotSeries = false)

{

var rs = new DataSeries(ds, string.Format("RS2t({0},{1},{2}", ds.Description, index, period));

var extSym = GetExternalSymbol(index, true);

var RS1 = ds / extSym.Close;

var Fast = EMAModern.Series(RS1, period); //Fast MA: Orange

var Med = SMA.Series(Fast, 7); //Medium MA: Green

var Slow = SMA.Series(Fast, 15); //Slow MA: Red

var Vslow = SMA.Series(Slow, 30); //V Slow MA: Blue

int Tier1 = 0, Tier2 = 0, Tier3 = 0, Tier4 = 0;

for (int bar = GetTradingLoopStartBar(Math.Max(period * 3, 30)); bar < ds.Count; bar++)

{

Tier1 = (Fastbar >= Medbar && Medbar >= Slowbar && Slowbar >= Vslowbar) ? 10 : 0;

Tier2 = (Fastbar >= Medbar && Medbar >= Slowbar && Slowbar < Vslowbar) ? 9 : 0;

Tier3 = (Fastbar < Medbar && Medbar >= Slowbar && Slowbar >= Vslowbar) ? 9 : 0;

Tier4 = (Fastbar < Medbar && Medbar >= Slowbar && Slowbar < Vslowbar) ? 5 : 0;

rsbar = Tier1 + Tier2 + Tier3 + Tier4;

}

if (plotSeries)

{

var rp = CreatePane(50, false, true);

PlotSeries(rp, RS1, Color.Black, ls, 1);

PlotSeries(rp, Fast, Color.DarkOrange, ls, 2);

PlotSeries(rp, Med, Color.MediumSeaGreen, ls, 2);

PlotSeries(rp, Slow, Color.Crimson, ls, 2);

PlotSeries(rp, Vslow, Color.SteelBlue, ls, 2);

}

return rs;

}

protected override void Execute()

{

int period = 10;

var lstIndices = new List()

{ "FXAIX", "FNCMX", "FSMDX", "FSSNX", "FSPGX", "FLCOX", "FPADX", "FSRNX", "FSAGX", "FSUTX", "FTBFX"};

var RS3x = Close * 0;

foreach (var fund in lstIndices)

{

RS3x += RS2t(Close, fund, period);

}

var RS4 = (RS3x / lstIndices.Count) * 10; //Scaled to 0 to 100

for (int bar = 0; bar < RS4.Count; bar++) RS4bar = Math.Round(RS4bar);

var RS4osc = SMA.Series(RS4, 3); //RS oscillator

var Mv = SMA.Series(RS4osc, 5); //RSosc's signal line

var rp = CreatePane(40, false, true);

PlotSeries(rp, RS4osc, Color.DarkSlateBlue, ls, 2, "RS4r Oscillator");

PlotSeries(rp, Mv, Color.Crimson, ls, 2, "SMA5");

HideVolume();

DrawHorzLine(rp, 80, Color.Red, LineStyle.Dashed, 1);

DrawHorzLine(rp, 100, Color.Black, LineStyle.Dashed, 1);

var mvRS4 = WMA.Series(RS4, 4); //Moving Avg of RS4r

var R5 = new DataSeries(Close, string.Format("R5({0})",period));

var x = Open * 0;

for (int bar = 1; bar < RS4.Count; bar++)

{

bool RS4up = (RS4bar >= 80 || RS4bar > mvRS4bar); //RS4r is above signal line

xbar = RS4bar >= 80 ? 1 : 0; //RS4r must be >= 80

}

//Avg of >80 scores in period

for (int bar = 1; bar < RS4.Count; bar++)

R5bar = (Sum.Series(x, period)bar / period) * 100;

var rp5 = CreatePane(20, false, true);

PlotSeries(rp5, R5, Color.Red, ls, 2, "R5");

int b = Bars.Count - 1;

if (b < Math.Max(period * 3, 30)) return;

//if ( RS4oscb > 80 ) BuyAtMarket(b + 1, Math.Round(RS4oscb).ToString());

if ( R5b > 80 ) BuyAtMarket(b + 1, Math.Round(R5b).ToString());

}

}

}Gene Geren (Eugene)

Wealth-Lab team